Company Financing Sources - Books&Co.

Introduction

When establishing a new company, one of the most critical challenges entrepreneurs face is securing adequate funding. This article explores the various sources of financing available to businesses at the time of their formation and discusses how strategic management of supplier payments can serve as an additional form of financing.

Traditional Sources of Financing

1. Personal Savings

Many entrepreneurs start their businesses using their personal savings. This method, often called bootstrapping, allows founders to maintain full control over their company but may limit growth potential.

2. Friends and Family

Loans or investments from friends and family can provide initial capital with potentially favorable terms. However, this approach carries personal risks and should be handled professionally to avoid damaging relationships.

3. Bank Loans

Traditional bank loans remain a common source of business financing. They typically require a solid business plan, good credit history, and often collateral. Terms can vary widely based on the bank and the business's risk profile.

4. Small Business Administration (SBA) Loans

In the United States, SBA-backed loans offer more favorable terms for small businesses. These loans are partially guaranteed by the government, reducing risk for lenders and potentially making it easier for businesses to qualify.

5. Angel Investors

High-net-worth individuals, known as angel investors, often provide capital for startups in exchange for equity or convertible debt. They frequently offer mentorship and industry connections alongside financial support.

6. Venture Capital

Venture capital firms invest in high-growth potential startups, typically in exchange for significant equity stakes. While they can provide substantial capital and expertise, they also expect rapid growth and may exert considerable influence over company decisions.

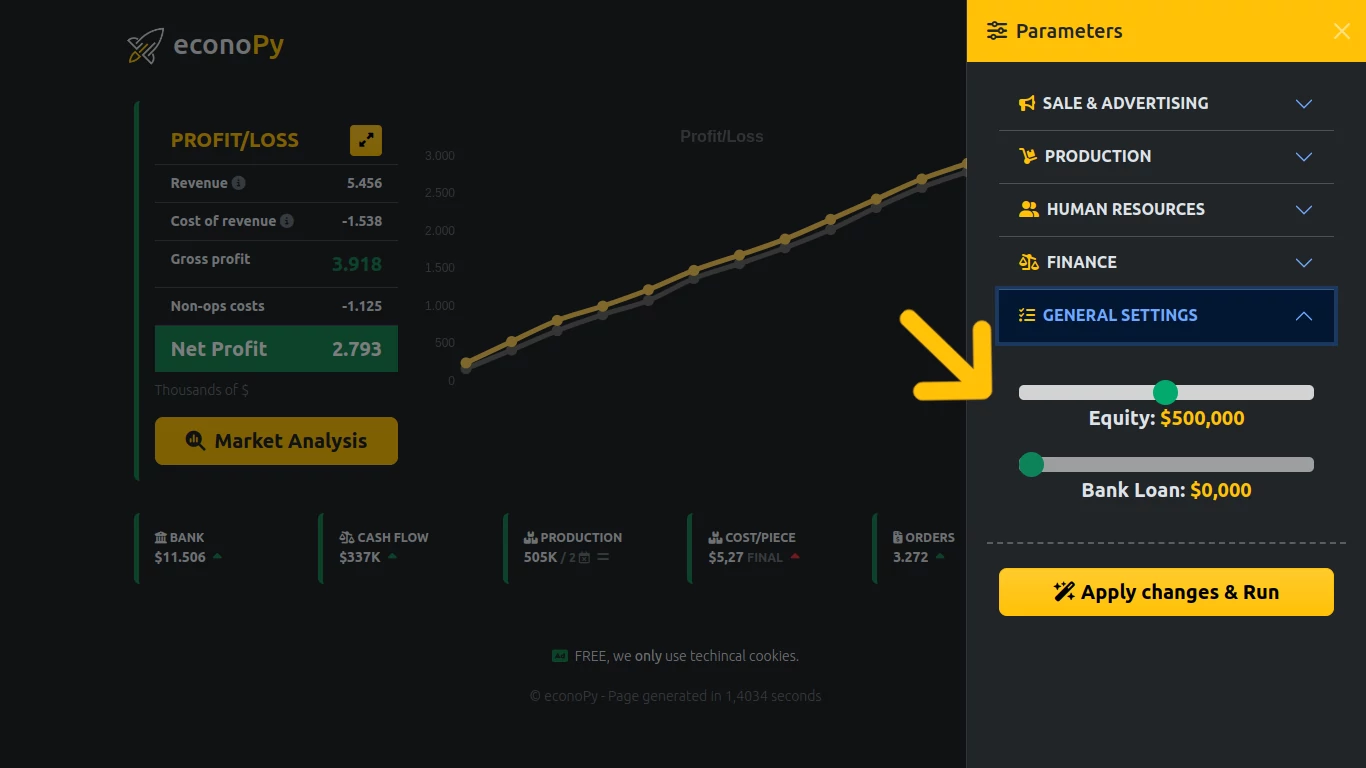

General Settings Equity

Alternative Financing Methods

7. Crowdfunding

Platforms like Kickstarter and Indiegogo allow businesses to raise funds from a large number of small investors or customers. This can be particularly effective for consumer products or services with broad appeal.

8. Peer-to-Peer Lending

Online platforms connecting borrowers directly with lenders have grown in popularity. These often offer more flexible terms than traditional banks but may come with higher interest rates.

9. Grants

Government agencies, non-profit organizations, and some corporations offer grants to businesses in specific industries or those addressing particular social or environmental issues. While highly competitive, grants provide funding that doesn't need to be repaid.

10. Incubators and Accelerators

These programs often provide a combination of seed funding, mentorship, and resources in exchange for equity. They can be particularly valuable for tech startups or other high-growth potential businesses.

Supplier Financing: Delaying Payments as a Form of Funding

An often-overlooked form of financing for new businesses is the strategic management of supplier payments. By negotiating extended payment terms with suppliers, companies can effectively use their accounts payable as a source of short-term, interest-free financing. This practice is sometimes referred to as "trade credit" or "supplier financing."

How It Works

- Negotiated Payment Terms: When establishing relationships with suppliers, businesses can negotiate payment terms that extend beyond the standard 30 days. Common extended terms might be 60, 90, or even 120 days.

- Cash Flow Benefit: By delaying payments, the company retains cash for a longer period, which can be used for other operational needs or growth initiatives.

- Interest-Free Financing: Unlike bank loans or credit cards, extended supplier payment terms typically don't accrue interest, making this an extremely cost-effective form of financing.

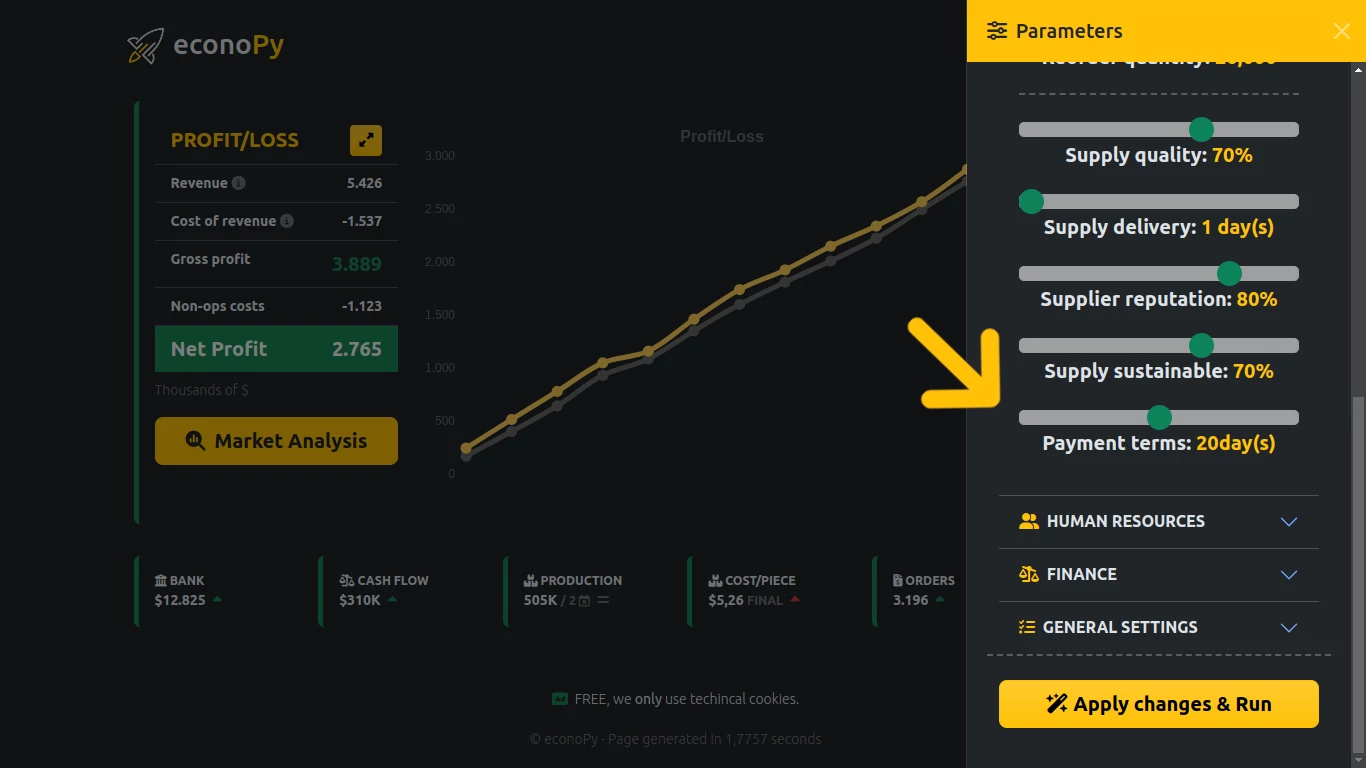

Production Payment termsAdvantages of Supplier Financing

- Improved Working Capital: Extended payment terms directly improve a company's working capital position by increasing current assets relative to current liabilities.

- Flexibility: Unlike formal loans, supplier financing can often be adjusted based on the company's needs and the specific supplier relationships.

- No Collateral Required: Unlike many traditional forms of financing, supplier credit typically doesn't require collateral.

- Builds Business Relationships: Negotiating favorable terms can help establish strong, long-term relationships with key suppliers.

Considerations and Potential Drawbacks

- Impact on Supplier Relationships: Consistently paying late or pushing for excessively long terms can strain supplier relationships and potentially lead to less favorable pricing or service in the future.

- Credit Rating Impact: Some suppliers report payment behavior to credit bureaus. Consistently late payments could negatively impact the company's credit rating.

- Potential for Higher Prices: Suppliers may factor in the cost of extended payment terms by charging higher prices for their goods or services.

- Cash Flow Management: While extended terms can improve cash flow, they require careful management to ensure the company can meet its obligations when payments come due.

Understanding the Cost of Capital and Return on Investment

When establishing a company, it's crucial to understand not just the sources of financing, but also the cost of capital and expected returns. This knowledge helps entrepreneurs make informed decisions about whether to pursue certain financing options and whether the business venture itself is financially viable.

Interest Rates and Borrowing Costs

When borrowing money, businesses typically pay interest. The interest rate can vary based on several factors:

- Company reputation

- Financial stability

- Collateral offered

- Business risk

- Loan duration

For example, if a company borrows $100,000 at an annual interest rate of 8%, the yearly interest cost would be $8,000 ($100,000 * 8 / 100). For this loan to be worthwhile, the company must be able to generate returns higher than 8% on this capital.

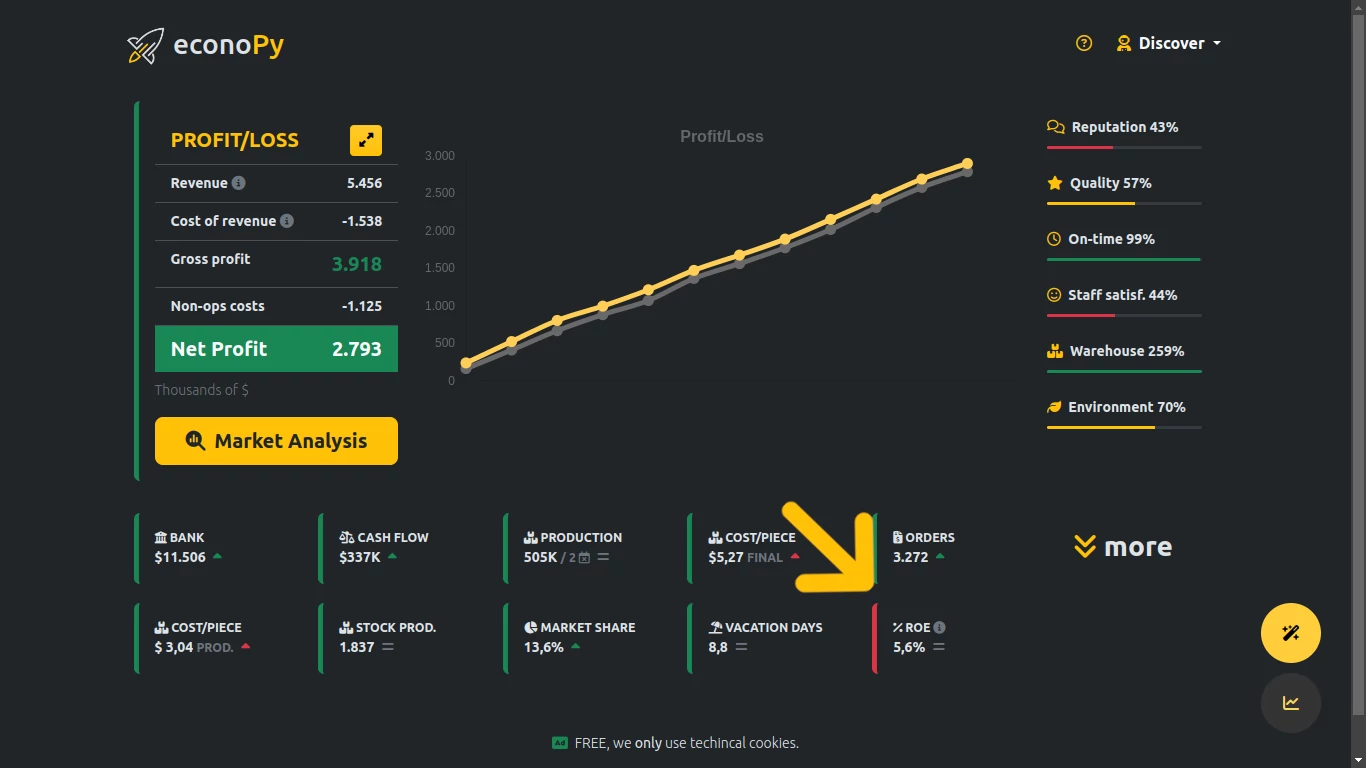

Evaluating Return on Investment

One key metric for assessing the profitability of an investment is the Return on Equity (ROE). This indicator can provide a preliminary assessment of whether borrowing money is advantageous. For instance, if the passive interest rate (cost of borrowing) is 5%, the company's ROE should be higher to justify the loan.

Comparing Business Investment to Alternative Investments

When deciding to start a business, it's essential to compare the expected returns with alternative investment options, such as government bonds or balanced mutual funds.

Consider this example:

An entrepreneur has $200,000 in cash and is considering starting a business. The average profit margin in the chosen industry is 6%. Low-risk investment alternatives offer a 4% return.

1. Business Investment:

- Expected profit: $200,000 * 6% = $12,000

- High risk of loss

- Capital is tied up and not easily liquidated

2. Low-risk Investment (e.g., government bonds):

- Expected return: $200,000 * 4% = $8,000

- Low risk

- Easily liquidated

In this scenario, the business venture offers only a 2% higher return compared to the low-risk alternative. Given the significantly higher risk and reduced liquidity associated with starting a business, this small difference might not seem sufficient motivation for the investment.

The Entrepreneurial Spirit

Despite the financial considerations, it's important to note that entrepreneurs are often visionaries who are driven by more than just financial returns. The desire to create, innovate, and prove oneself can often outweigh purely financial considerations.

Entrepreneurs frequently accept lower financial returns or higher risks due to:

- The potential for future growth and higher returns

- Personal satisfaction in building something of their own

- The opportunity to solve problems or make a difference in their chosen field

- The challenge and excitement of running a business

Balancing Financial and Non-Financial Factors

When deciding whether to start a business, entrepreneurs should consider both financial and non-financial factors:

1. Financial Considerations:

- Expected return on investment

- Risk level compared to alternative investments

- Cash flow projections

- Break-even analysis

2. Non-Financial Considerations:

- Personal passion and interest in the business area

- Potential for personal and professional growth

- Impact on work-life balance

- Opportunity to create jobs and contribute to the economy

By carefully weighing these factors, entrepreneurs can make more informed decisions about whether to pursue a business venture and how to finance it.

Conclusion

Financing a new business requires a multifaceted approach. While traditional sources like personal savings, loans, and equity investments remain crucial, alternative methods such as crowdfunding and strategic supplier financing can provide additional flexibility and benefits.

Particularly for new businesses, leveraging supplier relationships through extended payment terms can be an effective way to improve cash flow and working capital without incurring interest costs. However, this strategy must be implemented thoughtfully to maintain positive supplier relationships and overall financial health.

The most successful financing strategies for new businesses often involve a combination of these various sources, tailored to the specific needs, industry, and growth potential of the company. By understanding and strategically utilizing all available options, entrepreneurs can build a strong financial foundation for their new ventures.

Ultimately, while financial considerations are crucial when starting a business, they are not the only factors at play. Entrepreneurs must balance the potential financial returns against the risks, while also considering their personal goals, passions, and the potential non-financial rewards of building a successful enterprise. By thoroughly understanding both the financial landscape – including financing options, costs of capital, and potential returns – and their own motivations and risk tolerance, entrepreneurs can make more informed decisions about starting and funding their ventures.

Keywords: startup financing, business funding sources, venture capital, angel investors bank loans for startups, crowdfunding for businesses, supplier financing strategies sba loans, bootstrapping techniques peer-to-peer lending, business grants, startup incubators, return on investment for startups, entrepreneurial decision-making, cost of capital.